The Role of Financial Institutions in Climate Action

Climate change is one of the most pressing challenges of our time, and financial institutions have a crucial role to play in addressing this global issue. As the world increasingly recognizes the urgency of reducing greenhouse gas emissions and transitioning to a more sustainable economy, financial institutions are under growing pressure to align their investments and operations with climate action goals.

Investing in Sustainable Solutions

Financial institutions have the power to drive positive change by investing in sustainable solutions that support the transition to a low-carbon economy. By incorporating environmental, social, and governance (ESG) criteria into their investment decisions, financial institutions can direct capital towards projects and companies that are committed to reducing their carbon footprint and promoting sustainability.

Risk Management and Disclosure

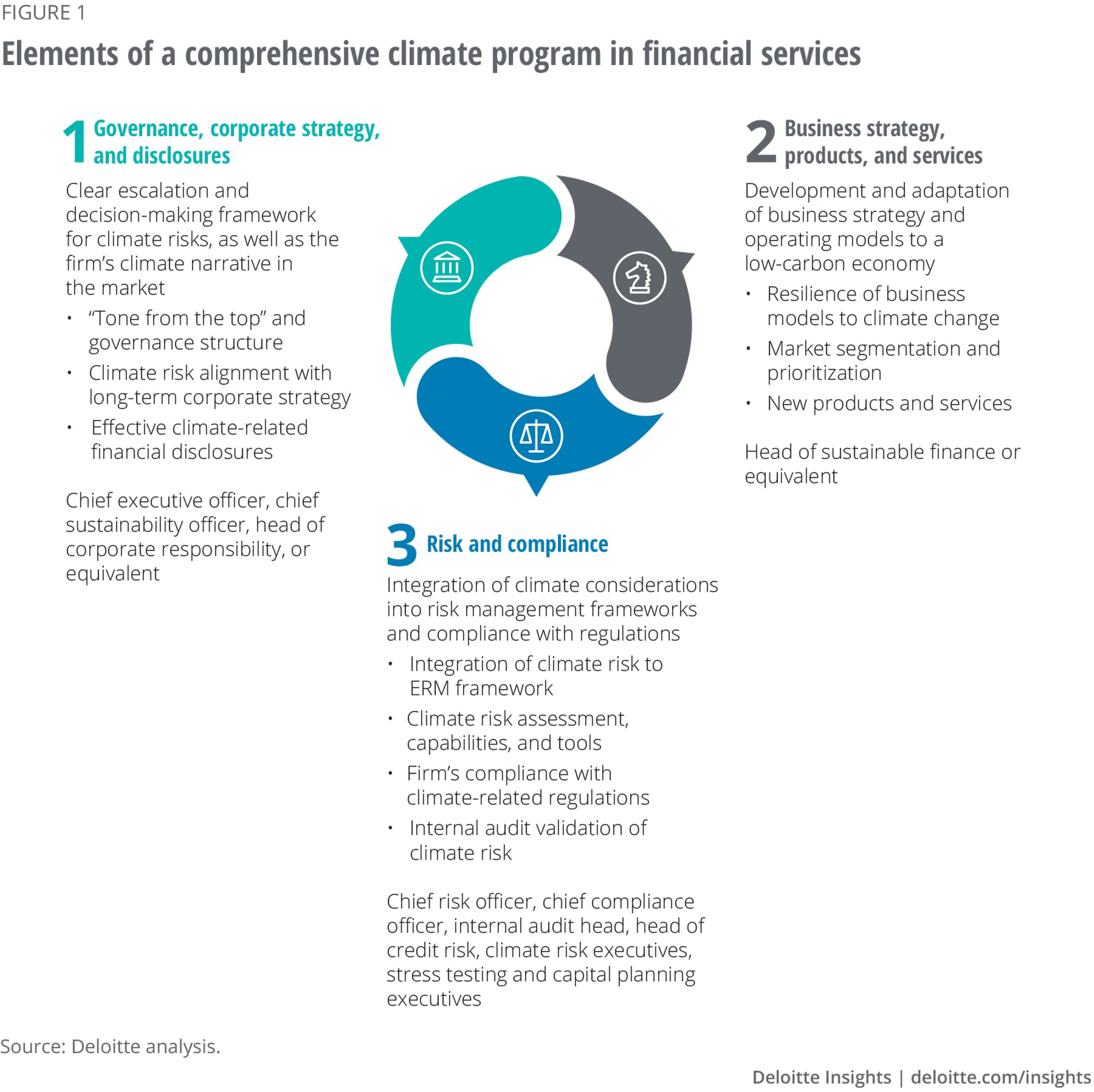

Climate change poses significant risks to the global economy, including physical risks from extreme weather events and transition risks from policy changes and market shifts. Financial institutions need to assess and manage these risks effectively to safeguard their investments and ensure long-term financial stability. Transparent disclosure of climate-related risks and opportunities is also essential for investors to make informed decisions.

Supporting Green Finance Initiatives

Financial institutions can play a key role in supporting green finance initiatives that promote investments in renewable energy, energy efficiency, sustainable infrastructure, and other climate-friendly projects. By offering green bonds, loans, and other financial products tailored to environmentally responsible projects, financial institutions can mobilize capital towards building a more sustainable future.

Collaboration and Advocacy

Collaboration among financial institutions, regulators, policymakers, businesses, and civil society is essential for driving meaningful climate action. Financial institutions can advocate for policies that incentivize sustainability practices, promote transparency in reporting climate-related risks, and encourage greater investment in green technologies. By working together towards common goals, we can accelerate progress towards a low-carbon economy.

Understanding Climate Action in Financial Institutions: Key Questions and Insights

- How do financial institutions contribute to climate action?

- What role do ESG criteria play in investment decisions related to climate action?

- How can financial institutions manage and disclose climate-related risks?

- What are green finance initiatives, and how do they support climate action?

- Why is collaboration among financial institutions, regulators, policymakers, and businesses essential for driving meaningful climate action?

How do financial institutions contribute to climate action?

Financial institutions play a vital role in climate action by leveraging their influence and resources to drive positive change. Through sustainable investments, risk management strategies, and support for green finance initiatives, financial institutions contribute to reducing greenhouse gas emissions and promoting environmental sustainability. By incorporating environmental, social, and governance criteria into their decision-making processes, financial institutions can direct capital towards projects and companies that are committed to addressing climate change. Additionally, through collaboration with stakeholders and advocacy for policies that incentivize sustainability practices, financial institutions can further amplify their impact on advancing climate action efforts globally.

What role do ESG criteria play in investment decisions related to climate action?

ESG criteria, which stand for environmental, social, and governance factors, play a pivotal role in investment decisions related to climate action within financial institutions. By incorporating ESG considerations into their investment strategies, financial institutions can assess the environmental impact of potential investments, evaluate how companies manage climate-related risks, and identify opportunities that align with sustainability goals. ESG criteria provide a framework for investors to prioritize investments in companies that demonstrate strong environmental stewardship, social responsibility, and effective governance practices, ultimately driving positive change towards a more sustainable future.

How can financial institutions manage and disclose climate-related risks?

Financial institutions can effectively manage and disclose climate-related risks by implementing robust risk assessment frameworks that take into account both physical and transition risks associated with climate change. This involves conducting thorough scenario analyses to understand the potential impacts of climate-related events on their portfolios and operations. By integrating climate risk considerations into their risk management processes, financial institutions can identify vulnerabilities, develop mitigation strategies, and enhance their resilience to climate-related shocks. Transparent disclosure of these risks through standardized reporting frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) guidelines is essential for providing stakeholders with relevant information to make informed decisions about investments and ensuring accountability in addressing climate risks.

What are green finance initiatives, and how do they support climate action?

Green finance initiatives refer to financial mechanisms and investments that are specifically designed to support environmentally sustainable projects and initiatives aimed at addressing climate change. These initiatives play a crucial role in advancing climate action by directing capital towards renewable energy, energy efficiency, sustainable infrastructure, and other environmentally friendly projects. By offering green bonds, loans, and other financial products tailored to support these initiatives, green finance helps mobilize funding for projects that reduce greenhouse gas emissions, promote resource efficiency, and contribute to building a more sustainable future. Through green finance initiatives, financial institutions can align their investments with climate action goals and drive positive environmental impact while also generating financial returns.

Why is collaboration among financial institutions, regulators, policymakers, and businesses essential for driving meaningful climate action?

Collaboration among financial institutions, regulators, policymakers, and businesses is essential for driving meaningful climate action because climate change is a complex and interconnected challenge that requires a coordinated effort from all sectors of society. Financial institutions have the power to allocate capital towards sustainable investments, regulators can set standards and guidelines for environmental performance, policymakers can create supportive frameworks and incentives for green initiatives, and businesses can innovate and implement sustainable practices. By working together, these stakeholders can leverage their respective strengths and resources to accelerate the transition to a low-carbon economy, mitigate climate risks, and create a more sustainable future for all.